|

1.

|

|

2.

|

|

3.

|

|

4.

|

|

5.

|

|

6.

|

Click OK.

|

|

8.

|

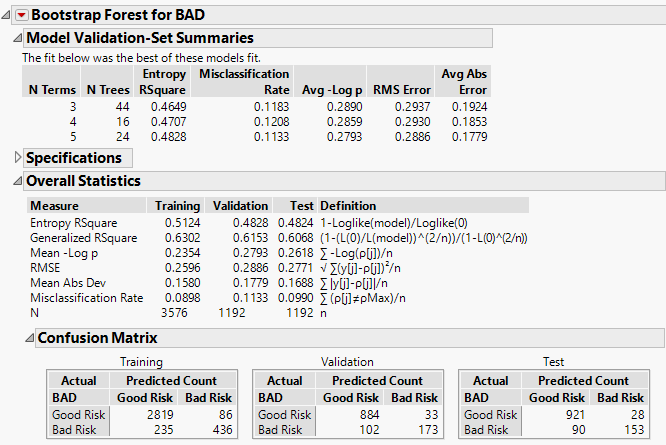

Select Multiple Fits over Number of Terms and enter 5 next to Max Number of Terms.

|

|

9.

|

(Optional) Select Suppress Multithreading and enter 123 next to Random Seed.

|

|

10.

|

Click OK.

|

|

11.

|

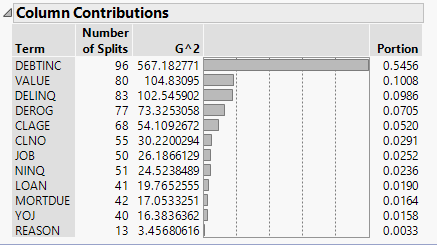

Click the red triangle next to Bootstrap Forest for BAD and select Column Contributions.

|

The Column Contributions report suggests that the strongest predictor of a customer’s credit risk is DEBTINC, which is the debt to income ratio. The next highest contributors to the model are DELINQ, the number of delinquent credit lines, and VALUE, the assessed value of the customer.