|

1.

|

|

2.

|

|

3.

|

|

4.

|

|

5.

|

|

6.

|

Click OK.

|

|

8.

|

Select Multiple Fits over Number of Terms and enter 5 next to Max Number of Terms.

|

|

9.

|

(Optional) Select Suppress Multithreading and enter 123 next to Random Seed.

|

|

10.

|

Click OK.

|

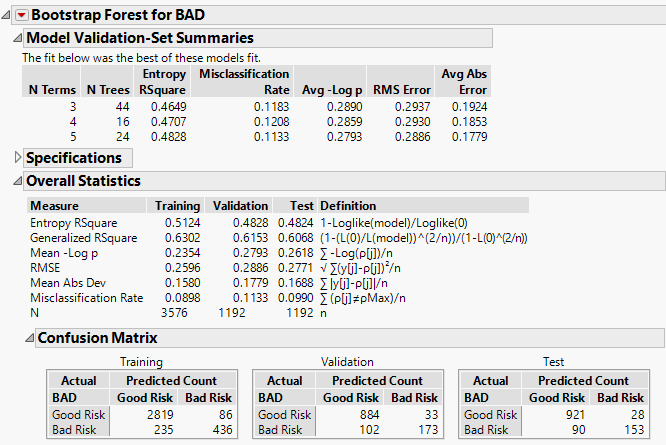

Figure 5.2 Overall Statistics Report

|

11.

|

Click the red triangle next to Bootstrap Forest for BAD and select Column Contributions.

|

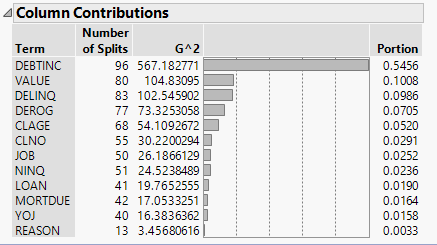

Figure 5.3 Column Contributions Report

The Column Contributions report suggests that the strongest predictor of a customer’s credit risk is DEBTINC, which is the debt to income ratio. The next highest contributors to the model are DELINQ, the number of delinquent credit lines, and VALUE, the assessed value of the customer.

|

1.

|

Select Analyze > Screening > Explore Missing Values.

|

|

2.

|

|

3.

|

Click OK in the Alert that appears.

|

The columns REASON and JOB are not added to the Y, Columns list because they have a Character data type. You can see how many values are missing for these two columns using Distribution (not illustrated in this example).

|

4.

|

Click OK.

|

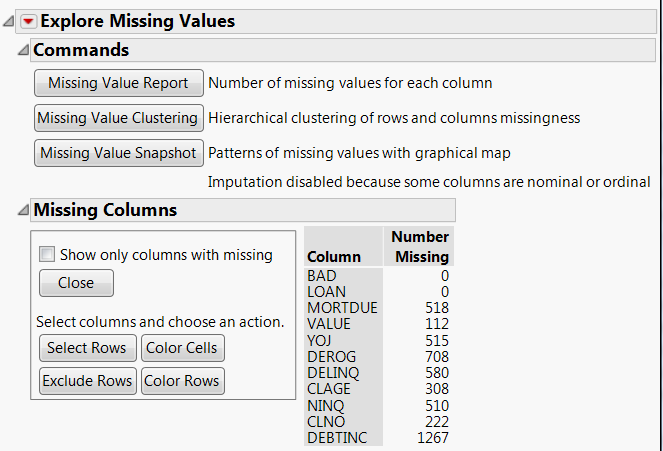

Figure 5.4 Missing Values Report

The DEBTINC column contains 1267 missing values, which amounts to about 21% of the observations. Most other columns involved in the Bootstrap Forest analysis also contain missing values. The Informative Missing option in the launch window ensures that the missing values are treated in a way that acknowledges any information that they carry. For details, see Informative Missing in Partition Models.

Example of Bootstrap Forest with a Categorical Response

Example of Bootstrap Forest with a Categorical Response