|

1.

|

|

2.

|

|

3.

|

|

4.

|

|

5.

|

Click OK.

|

|

1.

|

|

4.

|

Click the red triangle next to Partition for BAD and select Save Columns > Save Prediction Formula.

|

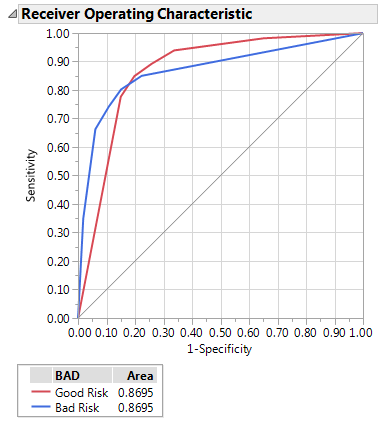

The columns Prob(BAD==Good Risk) and Prob(BAD==Bad Risk) contain the formulas that Informative Missing utility uses to classify the credit risk of future loan applicants. You are interested in how this model performs in comparison to a model that does not use informative missing.

|

1.

|

Click the red triangle next to Partition for BAD and select Redo > Relaunch Analysis

|

|

2.

|

De-select Informative Missing.

|

|

3.

|

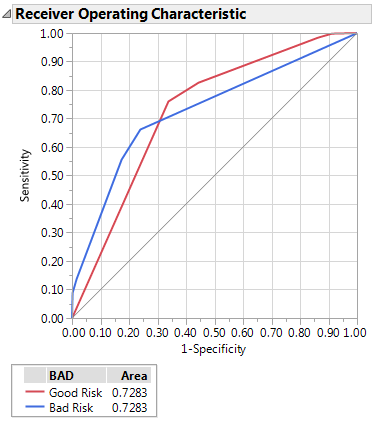

The columns Prob(BAD==Good Risk) 2 and Prob(BAD==Bad Risk) 2 contain the formulas that do not use the informative missing utility.

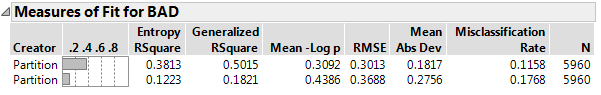

Next, compare the models using the Model Comparison platform to compare the two sets of formulas that you created in step 4 and step 3.

|

1.

|

Select Analyze > Predictive Modeling > Model Comparison.

|

|

2.

|

Select Prob(BAD==Good Risk), Prob(BAD==Bad Risk), Prob(BAD==Good Risk) 2, and Prob(BAD==Bad Risk) 2 and click Y, Predictors.

|

|

3.

|

Click OK.

|