Compare Proportions

If you have categorical X and Y variables, you can compare the proportions of the levels within the Y variable to the levels within the X variable.

Scenario

This example continues to use the Companies.jmp data table. In Compare Averages for One Variable, a financial analyst determined that pharmaceutical companies have higher profits on average than do computer companies.

The financial analyst wants to know whether the size of a company affects profits more for one type of company than the other? However, before examining this question, the financial analyst needs to know whether the populations of computer and pharmaceutical companies consist of the same proportions of small, medium, and big companies.

Discover the Relationship

1. Select Help > Sample Data Library and open Companies.jmp.

2. If you still have the Companies.jmp data file open from the previous example, you might have rows that are excluded or hidden. To return the rows to the default state (all rows included and none hidden), select Rows > Clear Row States.

3. Select Analyze > Fit Y by X.

4. Select Size Co and click Y, Response.

5. Select Type and click X, Factor.

6. Click OK.

Figure 5.19 Company Size by Company Type

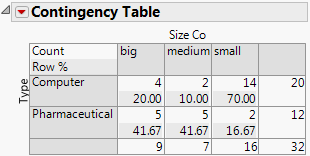

The Contingency Table contains information that is not applicable for this example. Click the Contingency Table red triangle and deselect Total % and Col % to remove that information. Figure 5.20 shows the updated table.

Figure 5.20 Updated Contingency Table

Interpret the Results

The statistics in the Contingency Table are graphically represented in the Mosaic Plot. Together, the Mosaic Plot and the Contingency Table compare the percentages of small, medium, and big companies between the two industries. For example, the Mosaic Plot shows that the computer industry has a higher percentage of small companies compared to the pharmaceutical industry. The Contingency Table shows the exact statistics: 70% of computer companies are small, and about 17% of pharmaceutical companies are small.

Interpret the Test

The financial analyst has looked at only a sample of companies (the companies in the data table). The financial analyst needs to know whether the percentages differ in the broader populations of all computer and pharmaceutical companies.

To answer this question, use the p-value from the Pearson test in the Tests report (Figure 5.19). Since the p-value of 0.011 is less than the significance level of 0.05, the financial analyst concludes the following:

• The differences in the sample data are statistically significant.

• The percentages differ in the broader population.

Now the financial analyst knows that the proportions of small, medium, and big companies are different, and can answer the question: Does the size of company affect profits more for one type of company than the other?